Gas Temptation: The return of Nord Stream may be just the first step in the gas mega-alliance that Trump is trying to use to entice Putin

The 'big deal' that Donald Trump apparently dreams of striking with Vladimir Putin may include not only political agreements and arms control deals but also a significant economic component aimed at weakening Russia’s ties with China.

In this context, any potential discussion of US-Russia cooperation in the Arctic inevitably raises the issue of Russia’s gas reserves in the region and their development prospects, as well as the unblocking of already developed fields whose products currently lack markets due to sanctions and the halt of exports to Europe.

Recent rumors about the possible revival of Nord Stream 2 should be considered within this framework. The idea being floated involves US mediation in the delivery of Russian gas to Europe.

While such a development would contradict the EU’s policies in recent years, post-war pressure to resume gas supplies could become very strong in Europe. Cheap pipeline gas remains a key competitive advantage for European industry.

However, a Nord Stream deal might only be the first step in a broader gas partnership. If Russia restores its pre-war gas export volumes, the combined export share of Russia and the US could reach nearly 40%.

The idea of a global gas alliance with Russia may become part of the national energy dominance strategy that Trump has tasked a specially created council with developing. The US is being pushed toward cooperation with Russia by the threat of an alternative gas alliance forming, with China playing a key role.

Murky waters: the return

Although the specifics of the ‘big deal’ Trump envisions with Putin – where ending the war in Ukraine on terms favorable to Moscow is seen as his key bargaining chip – remain unknown, it is reasonable to assume that beyond political and arms agreements, it would include a major economic dimension. This economic aspect, combined with the promised full or partial lifting of sanctions, is intended to support Trump’s strategic plans to weaken Russia’s ties with China, replacing them with stronger economic links to the United States.

As we have previously written, of the arenas of cooperation through which the US is enticing Russia is likely to be agreements on the 'division of the Arctic' and the exploitation of its natural resources (→ Re:Russia: Arctic Blitz). However, this prospect inevitably raises the question of Russia’s gas reserves and their potential development. As of today, gas from even Russia’s already developed fields has been effectively 'locked' due to the shutdown of Nord Stream and sanctions against Russian LNG projects. It is in this context that last week’s rumors about intense informal discussions on the possible revival of Nord Stream 2 should be viewed.

The Wall Street Journal first reported that Nord Stream 2 could be revived as early as the end of 2024. It was revealed that the assets of Swiss company Nord Stream 2 AG, the pipeline operator, are being pursued by American businessman Steven Lynch, founder of the investment firm Monte Valle and a known supporter of Donald Trump. Lynch has reportedly approached the US Treasury Department, seeking permission to participate in the bidding process once it begins. Lynch is likely better known in Russia than in the US In 2007, he acquired the foreign assets of Yukos, which was later revealed to have been done on behalf of the founders of the investment firm Renaissance Capital, Stephen Jennings and Richard Deitz.

In early March, sources told the Financial Times, as well as German publications Handelsblatt and Bild, that US investors, including Lynch, were still interested in Nord Stream 2 assets. According to Bild, Richard Grenell, the US President's Special Envoy for Special Assignments, has joined the negotiations. Additionally, media sources have discovered that the project has a new operational manager – former Nord Stream 2 CEO Matthias Warnig, a longtime acquaintance of Vladimir Putin. According to The Wall Street Journal, while serving in Dresden, KGB officer Putin recruited Warnig, then a Stasi officer. Interestingly, Warnig is also apparently an acquaintance of Lynch. According to Reuters, in a deal to acquire Yukos' foreign assets, Warnig provided Lynch with support for Rosneft and was rewarded with a stake in Renaissance Capital.

American temptation

How exactly a revived Nord Stream 2 would function remains somewhat unclear. However, sources from Financial Times suggest that the pipeline operator would be controlled by American investors. Under this arrangement, they would purchase gas from Gazprom and resell it to European consumers. This setup, sources claim, would allow the EU to avoid formally reestablishing relations with Russia – something it is unwilling to do – while American investors would essentially 'profit for doing nothing.' This situation is expected to develop further soon. Nord Stream 2 is undergoing bankruptcy proceedings, after which its assets will be put up for sale. This process was initially scheduled to take place in January but has been granted a four-month extension.

Until recently, the prospect of Europe restoring ties with Gazprom seemed highly unlikely. In fact, by 2027, Europe had planned to completely phase out Russian hydrocarbons as well as nuclear fuel. However, the European Commission has since postponed the publication of the corresponding detailed plan. At the official level, the EU maintains that it is not interested in reviving Nord Stream 2, as it seeks to reduce dependence on what it considers an 'unreliable partner': Russia.

However, economically, the prospect of resuming gas supplies is highly attractive, particularly for German industry. In addition to pressure from pro-Russian EU members such as Hungary and Slovakia, powerful lobbying forces within Germany itself may push for the project. According to Bloomberg, some German business leaders and politicians have already begun discussing the restoration of gas imports, although so far, mainly in the eastern regions, where pro-Russian far-right and far-left parties hold significant influence. For now, representatives of the federal government and major corporations like BASF categorically rule out any revival of cooperation with Russia and Gazprom. However, if hostilities end, peace agreements are signed, and the US lifts sanctions on Russia, the argument that cheap pipeline gas is a critical competitive advantage for European (and especially German) industry will carry significant weight. Over the past five years, natural gas prices in the US have averaged 70% lower than in Europe, Bloomberg calculates. This price gap has given America a major competitive edge over Europe and supported Trump’s policy of bringing manufacturing back to the US from overseas.

Europe's double bind

The resumption of Russian gas flows through Nord Stream with American intermediaries presents a unique opportunity to secure EU and US control over Europe’s energy supply until the fossil fuel era ends, Steven Lynch told The Wall Street Journal late last year. However, the reality is far more complex.

The surge in European demand for liquefied natural gas (LNG), combined with the sharp decline in Russian pipeline deliveries following the Ukraine war, allowed the US to become the world’s largest gas supplier by mid-2023. In the European market, the US now plays the role of a critical supplier – one whose exit would be nearly impossible to replace. In 2024, according to the European LNG Tracker project, the US will account for almost half of Europe’s LNG imports. However, LNG supplies account for only a third of all gas supplies to Europe, so the US share of EU gas imports was about 18% in 2023-2024, according to Breugel's calculations.

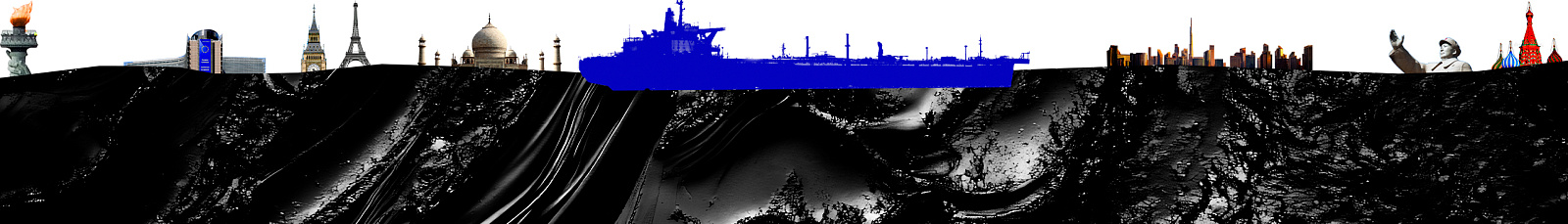

Structure of EU gas imports, 2021-2024, %

Russia, the second-largest supplier of liquefied natural gas (LNG), accounted for 19% (21.3 billion cubic meters) of total LNG deliveries to Europe in 2024, representing just 7% of the EU’s overall gas imports. However, Russia also supplied an additional 33.3 billion cubic meters via pipelines, bringing its total share of European gas imports to approximately 19% – equal to that of the US – as Russia significantly ramped up both pipeline and LNG exports. Together, Russia and the US accounted for about 40% of the EU’s total gas imports.

Restarting one line of Nord Stream would add another 25.5 billion cubic meters per year, equivalent to about 9% of EU gas imports. If supplies were fully restored, Russian pipeline gas alone would represent 20% of total European gas imports, while Russia’s overall share, including LNG, would rise to 27–28%. Under this scenario, combined imports from the US and Russia would approach half of Europe’s total gas supply. In other words, Europe’s previous dependence on Russian gas would be replaced by a new reliance on both Russia and the US – a shift that takes on a different significance in the current geopolitical climate and in the context of Europe’s aspirations for strategic autonomy as a global power.

At first glance, the plan promoted by the American administration to return Nord Stream looks like a paradox. During his previous term, Trump was the main architect of sanctions against the pipeline, aiming to replace Russian pipeline gas with American LNG. However, in the long run, a Russian-American gas alliance could prove to be a highly attractive proposition.

‘Energy dominance’ and a gas OPEC

During his election campaign, Trump pledged to boost US oil production by 3 million barrels per day (more than 20%) under his so-called ‘3-3-3’ plan, which also aims to cut the budget deficit to 3% of GDP and sustain 3% annual economic growth. However, according to Sergei Vakulenko, an expert at the Carnegie Berlin Centre, this plan is unfeasible (→ Re:Russia: Talk, baby, talk). The US government lacks the tools to expand oil production to such an extent, and even if it could, the resulting drop in global oil prices would hurt American shale projects. Nevertheless, Trump’s plan becomes ‘entirely realistic’ if measured not in barrels of oil but in barrels of oil equivalent (a metric that includes natural gas), argues Dan Yergin, an expert on the history of the oil industry and vice president at S&P Global, in an interview with Bloomberg. Raul LeBlanc, an analyst at S&P Global shares this view.

Unlike the oil market, the gas market still has significant room for growth. According to Bloomberg calculations, LNG production could increase by 60% during Trump’s presidency. While both oil and gas markets are approaching peak demand, the International Energy Agency (IEA) predicts that oil consumption will plateau by the end of this decade, whereas natural gas demand will not level off until after 2035. Global gas trade volumes are expected to continue rising at least until the middle of the century. Pipeline gas supply is projected to peak at 499 billion cubic meters in 2030 before beginning a gradual decline, following the same trajectory as oil. Meanwhile, LNG supply is expected to grow from the current 546 billion cubic meters to 690 billion in 2030, 719 billion in 2035, and 830 billion by 2050. Natural gas has traditionally been called a 'bridge fuel' – a cleaner alternative to coal on the path toward a fossil-free future. However, given current forecasts, LNG, in particular, is increasingly being seen as 'the fuel of the future,' concludes Mike Sommers, executive director of the American Petroleum Institute (API), in a conversation with Bloomberg.

Shares of top 5 global gas exporters, 2013-2023, %

In 2019, Russian gas exports accounted for nearly 21% of the global total, but this share has now declined to 10.2%. Meanwhile, the US has increased its share from 10.6% to nearly 18% over the same period. If Russia regains its previous market share while the US continues expanding its gas exports, the combined share of the two countries in global gas exports could reach 40–45% in the long run. Given that, under Lynch’s plan, Russia’s European gas supplies would be under joint Russian-American control and the US would become a partner in developing new Russian gas fields, this alliance starts to resemble a kind of 'Gas OPEC’.

These grandiose plans align well with the broader ideology of the Trump administration, which, just one month ago, established the National Council for Energy Dominance, tasking it with developing a strategy for securing American supremacy in the global energy market. It follows logically that a key element of such a strategy would be preventing the formation of a gas alliance between China, Russia, which according to OPEC, holds nearly a quarter of the world’s proven gas reserves – and Iran, which accounts for another 17%. The development of these reserves would require a financially strong partner, and concerns that China might eventually fill this role are likely a driving force behind the Trump administration’s push to strengthen a gas partnership with Russia.